The Intriguing World of Cloned Bank Cards

In today's digital landscape, the proliferation of cloned bank cards poses significant challenges and risks for businesses and consumers alike. As technology evolves, so do the techniques employed by fraudsters, leading to an urgent need for heightened awareness and robust security measures. This article delves deep into the realm of cloned bank cards, examining their implications for businesses, the measures to prevent such occurrences, and strategies to enhance overall financial security.

What Are Cloned Bank Cards?

Cloned bank cards refer to counterfeit cards that have been created using stolen card information. These counterfeit cards can be used to withdraw cash, make purchases, and conduct other financial transactions as if they were genuine. The cloning process often involves illicit methods to capture sensitive data, including:

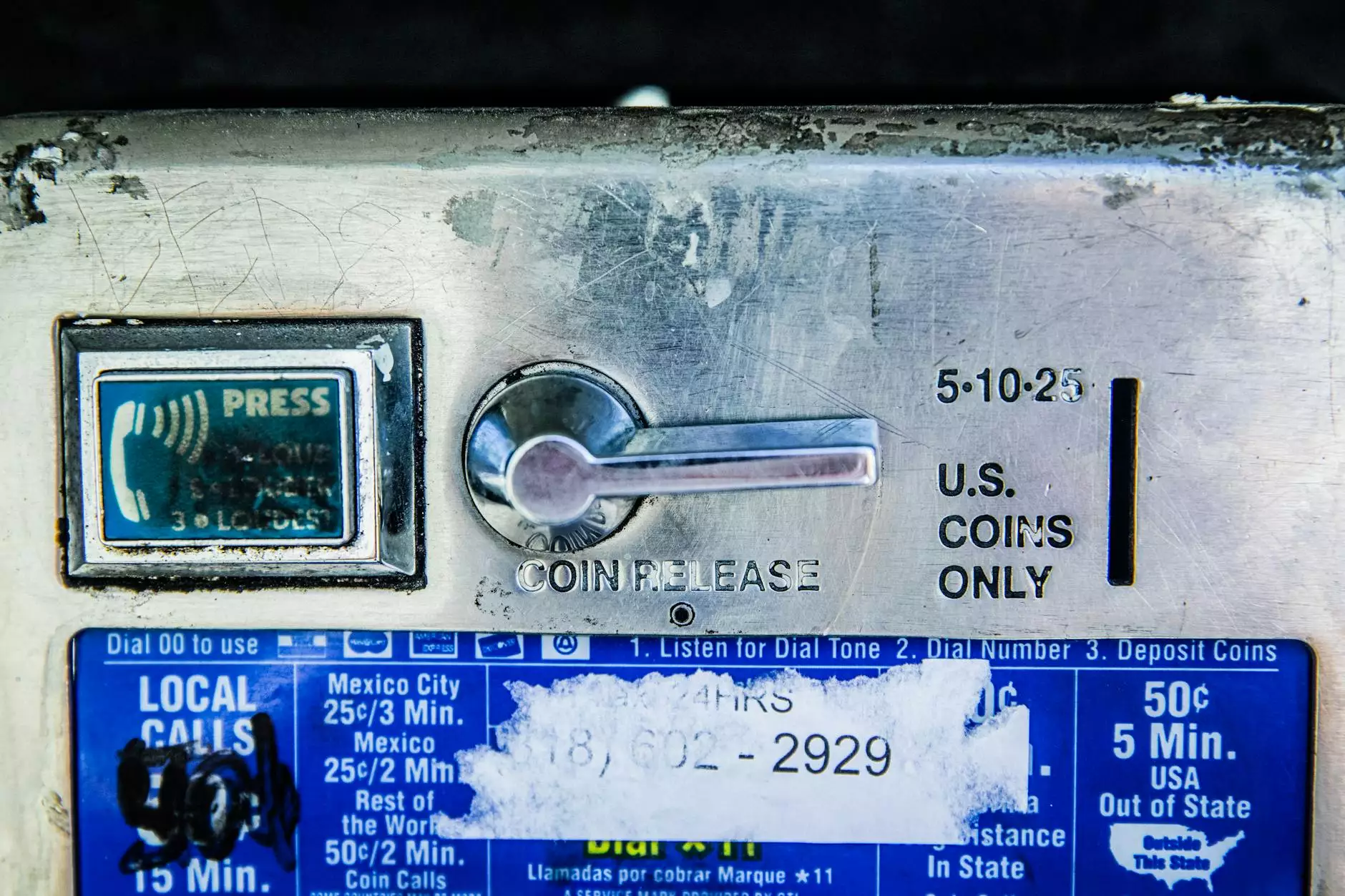

- Skimming: Using a small device attached to card readers to record magnetic stripe information from legitimate cards.

- Phishing: Deceptive emails or websites designed to trick users into providing their financial information.

- Data breaches: Unauthorized access to databases where card information is stored.

This stolen data is then embedded onto blank cards, allowing fraudsters to use them for fraudulent transactions.

The Impact of Cloned Bank Cards on Businesses

The implications of cloned bank cards extend beyond fraudulent transactions—they can significantly disrupt business operations. Here are several ways businesses can be affected:

1. Financial Losses

Businesses that fall victim to cloned bank cards may experience direct financial losses. Unauthorized transactions can rapidly drain funds, often leaving businesses with the burden of managing chargebacks and disputes.

2. Reputation Damage

Trust is a vital component of customer relationships. If customers become aware that a business has faced fraud incidents, this can lead to a deterioration of trust and long-term reputational harm.

3. Increased Operational Costs

In the wake of fraud, businesses often incur additional operational costs related to security upgrades, fraud investigation, and legal fees. Investing in better technology and systems may become necessary to prevent future occurrences.

Preventing Cloned Bank Cards: Essential Strategies for Businesses

To combat the threat of cloned bank cards, businesses must implement various security measures. Below are actionable strategies that can help safeguard transactions:

1. Implement Advanced Payment Technologies

Investing in EMV (Europay, MasterCard, and Visa) technology is crucial. EMV cards contain a chip that generates a unique transaction code, making it extremely challenging for fraudsters to clone them.

2. Regularly Monitor Financial Activities

Set up alerts and conduct regular audits of all financial transactions. This practice can help identify suspicious activities early, allowing for immediate action to mitigate further risks.

3. educate Employees and Customers

Conduct training programs aimed at educating both employees and customers about the dangers of fraud and the importance of secure practices. Providing information on how to recognize phishing attempts and fraudulent transactions can empower stakeholders.

Recognizing the Signs of Cloned Bank Card Use

Being vigilant can help identify cloned bank card usage before significant damage occurs. Here are warning signs to watch for:

- Inconsistent transaction patterns: Unusual spending behavior or transactions outside the norm can indicate fraud.

- Declined transactions: If legitimate transactions are being unexpectedly declined, this could suggest that the card data has been compromised.

- Multiple purchases within a short time frame: A sudden spike in transaction volume might point to abusive card use.

Legal Implications and Responsibilities

It's crucial for businesses to understand their legal responsibilities regarding the protection of customer data. Failure to protect sensitive information can lead to severe penalties and legal repercussions. Familiarizing yourself with regulations such as PCI DSS (Payment Card Industry Data Security Standard) is essential for maintaining compliance.

Key Regulations to Familiarize Yourself With

- GDPR: The General Data Protection Regulation outlines the responsibilities of businesses in handling personal data.

- PCI DSS: This set of standards is designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment.

Building a Secure Business Infrastructure

Establishing a secure infrastructure is paramount in the fight against financial fraud. Here are steps businesses can take:

1. Use Secure Networks

Ensure that both in-store and online transactions occur over secure networks. Utilize HTTPS for online transactions and keep your Wi-Fi secured with strong passwords.

2. Regular Software Updates

Keeping software and systems updated is vital for protecting against vulnerabilities that fraudsters could exploit.

3. Work with Trusted Payment Processors

Partnering with reputable payment processing companies that have established security measures can provide an additional layer of protection against fraud.

The Future of Payment Security

The landscape of payment security is continually evolving. As technology advances, so do the methods of fraud. To stay ahead, businesses must be proactive. Trends to watch include:

- Biometric authentication: Utilizing fingerprints, facial recognition, and other biometric measures can provide enhanced security.

- Blockchain technology: The decentralized nature of blockchain could offer solutions in securing transactions and preventing fraud.

Conclusion: Taking Action Against Fraud

Understanding the complexities surrounding cloned bank cards is essential for every business operating in today's digital world. By implementing the right strategies, maintaining vigilance, and adhering to legal responsibilities, businesses can mitigate the risks associated with financial fraud. The key is not just in response but in moving forward with a proactive mindset toward safeguarding financial transactions. Only then can you build a resilient business capable of thriving in an increasingly complex economic environment.

Additional Resources

For more information on combating financial fraud and enhancing security protocols, consider the following resources:

- Payment Card Industry Security Standards Council

- Federal Trade Commission - Reporting Fraud

© 2023 Undetected Banknotes. All rights reserved.